NEWSLETTER

01/2025

The EU's Corporate Sustainability Reporting Directive

A demanding task for European industry - and little coherence with other reporting requirements

The EU Corporate Sustainability Reporting Directive (CSRD) requires companies to include a sustainability report in a separate section of their annual report. Other related reporting requirements arise from the EU Taxonomy Regulation. The following article provides a brief overview of the most important issues.

Both large and small and medium-sized enterprises are affected by the reporting requirements. The introduction of sustainability reporting will be staggered according to the size of the company and its capital market orientation, see Table 1.

| From 2024 on | Companies with more than 500 employees that are already required to report in accordance with the EU Non-Financial Reporting Directive |

| From 2025 on | All large companies (whether listed or not) that fulfil at least two of the following criteria: more than 250 employees; more than EUR 50 million in turnover; more than EUR 25 million in total assets. |

| From 2026 on | Listed SMEs |

| From 2028 on | Non-EU companies that generate an annual net turnover of more than 150 million euros in the EU and have at least one subsidiary or branch in the EU. |

Table 1: For whom is the CSRD relevant?

What must be reported?

The sustainability report must contain the information necessary to understand the impact of the company's activities on sustainability issues and the impact of sustainability issues on the company's business performance, results and overall position. This includes a description of the business model and strategy, sustainability targets and progress, the role of senior management in managing sustainability issues, the company's policy on sustainability issues, and the processes and measures in place to mitigate potential negative impacts along the value chain. Small and medium sized companies can limit the disclosure in the sustainability report to certain information.

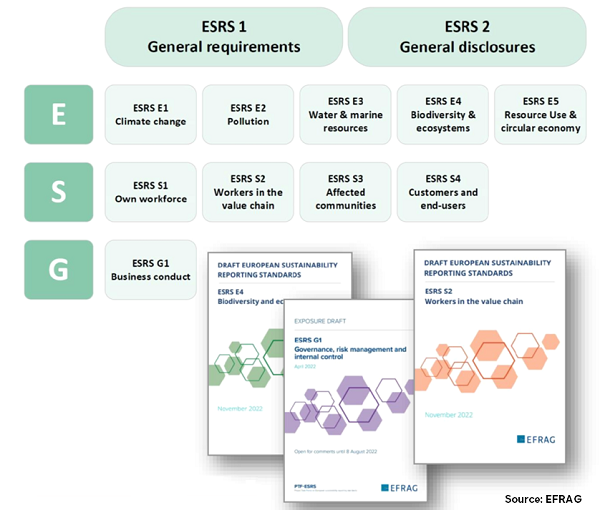

In addition to the general points mentioned above, the content of the report must be aligned with the standards developed by EFRAG, the European Financial Reporting Advisory Group. These European Sustainability Reporting Standards (ESRS) cover climate change, pollution, water, biodiversity/ecosystems, circular economy, own workforce, labour along the value chain, affected communities, consumers and end users, and corporate policy (see Figure 1 below). In total, this results in over 1,000 different data points, most of which need to be reported qualitatively and some quantitatively. EFRAG has published a list of specific data points, both mandatory and voluntary, which can provide guidance (More details).

Figure 1: Standards developed by EFRAG (ESRS)

Does everything have to be reported?

No. Reporting is only required for sustainability issues that (1) have an impact on a company's financial position or (2) where the business has an impact (positive or negative, potential or actual) on the environment or society. This is assessed as part of a mandatory double materiality assessment.

No materiality assessment is required for ESRS 2 (General Disclosures) as these items are generally reportable. If a company deems ESRS E1 (Climate Change) to be not material, there is a comprehensive obligation to justify and explain the results of the materiality assessment in relation to the impacts, risks and opportunities of climate change on the company and the effects of the company's activities on climate change.

Is a specific format required?

Yes, starting with the 2026 reporting year, the sustainability report must be prepared in XHTML (Extensible Hypertext Markup Language) format. In addition, the information in the sustainability report should be presented and tagged in a machine-readable format using eXtensible Business Reporting Language (XBRL).

Who reviews the report?

The sustainability report must be verified by an auditor, although this task may be performed by the auditor of the annual or consolidated accounts. Member States may also authorise an independent certification service provider established in their territory to carry out this task. Employee representatives must also be involved in the preparation of the report. The audit must be carried out first with limited assurance and then with reasonable assurance.

What is the role of the EU Taxonomy?

The EU Taxonomy Regulation sets out criteria for determining the environmental sustainability of economic sectors. In the future, investment funds are to be channelled primarily into 'green' economic activities. Companies in the cement industry that are required to report under the CSRD are also required to report under the Taxonomy. Information on so-called 'taxonomy-compliant' sales revenues, investments and operating expenses must be included in the management report. The EU Taxonomy Compass can be used to determine when such compliance can be assumed for clinker and cement production (More details). For example, specific CO₂ emissions per tonne of clinker must be below 722 kg or 469 kg per tonne of cement. In addition, certain minimum requirements must be met with regard to water use, pollution prevention, biodiversity and social standards.

Challenges and opportunities ahead

Both the CSRD and the Taxonomy Regulation represent major challenges for the European cement industry. The work involved in conducting the materiality assessment, collecting the data and preparing the report in the required machine-readable format is enormous.

In addition, other directives such as the Industrial Emissions Directive or the Corporate Sustainability Due Diligence Directive (CSDDD) also require reporting. Then there are national reporting requirements. The question is why the amount of data to be published is so huge and why the reporting requirements are not combined.